2024 Schedule A Itemized Deductions Worksheet

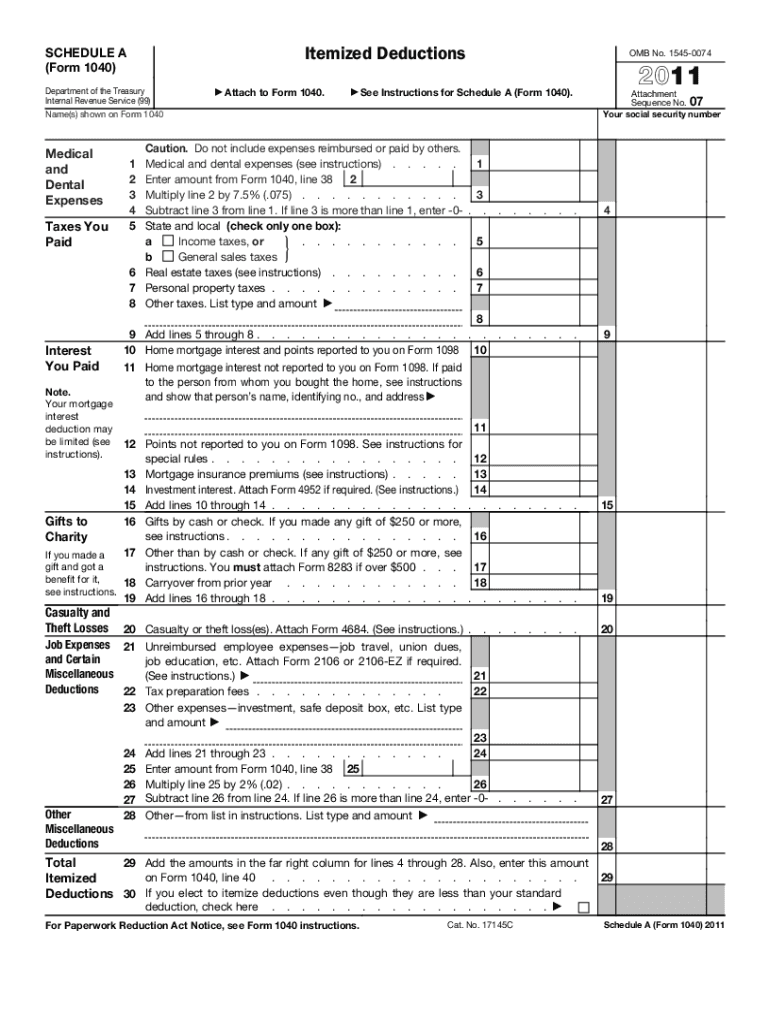

2024 Schedule A Itemized Deductions Worksheet – For a taxpayer whose itemized deductions are less than indicate that you want to itemize your deductions using Schedule A. You will want to verify the amount of property taxes paid to be . Information about SALT taxes and other possible itemized deductions is input into Schedule A on the return. These potential deductions include: The amount paid for state income taxes or sales taxes. .

2024 Schedule A Itemized Deductions Worksheet

Source : www.investopedia.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.comRealtor tax deductions worksheet: Fill out & sign online | DocHub

Source : www.dochub.comEmployee’s Withholding Certificate

Source : www.irs.govNurse Tax Deduction Worksheet Fill Online, Printable, Fillable

Source : nurse-tax-deduction-worksheet.pdffiller.comW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.comList of itemized deductions worksheet: Fill out & sign online | DocHub

Source : www.dochub.com2024 Form W 4P

Source : www.irs.govIRS Form W 4P walkthrough (Withholding Certificate for Periodic

Source : www.youtube.com2024 Schedule A Itemized Deductions Worksheet All About Schedule A (Form 1040 or 1040 SR): Itemized Deductions: Stay updated on the standard deduction amounts for 2024, how it works and when to claim it. Aimed at individual filers and tax preparers. . With tax season underway, you’ll need to know the standard deduction amount you can claim for 2023. The standard deduction amounts tend to increase slightly each year to adjust for inflation. Let’s .

]]>:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)